Do you know how to stay fundamentally sound?

Contact me today to get further, farther, and faster in real estate.

Our goal is to make Real Estate Simple. 🏡

📲 979-764-2100

💻 susanh@century21bcs.com

🌐 susanhilton.com

Do you know how to stay fundamentally sound?

Contact me today to get further, farther, and faster in real estate.

Our goal is to make Real Estate Simple. 🏡

📲 979-764-2100

💻 susanh@century21bcs.com

🌐 susanhilton.com

Buying a home can help you escape the cycle of rising rents, it’s a powerful Wealth building tool, and it’s typically considered a good hedge against inflation. If you’re ready to take advantage of the benefits of homeownership, let’s connect

Our goal is to make Real Estate Simple. 🏡

📲 979-764-2100

💻 susanh@century21bcs.com

🌐 susanhilton.com

The support of a CENTURY is one call away!

Our goal is to make Real Estate Simple. 🏡

📲 979-764-2100

💻 susanh@century21bcs.com

🌐 susanhilton.com

While the Federal Reserve is working hard to bring down inflation, the latest data shows the inflation rate is still high, remaining around 8%. This news impacted the stock market and added fuel to the fire for conversations about a recession.

You’re likely feeling the impact in your day-to-day life as you watch the cost of goods and services climb. The pinch it’s creating on your wallet and the looming economic uncertainty may leave you wondering: “should I still buy a home right now?” If that question is top of mind for you, here’s what you need to know.

In an inflationary economy, prices rise across the board. Historically, homeownership is a great hedge against those rising costs because you can lock in what’s likely your largest monthly payment (your mortgage) for the duration of your loan. That helps stabilize some of your monthly expenses. James Royal, Senior Wealth Management Reporter at Bankrate, explains:

“A fixed-rate mortgage allows you to maintain the biggest portion of housing expenses at the same payment. Sure, property taxes will rise and other expenses may creep up, but your monthly housing payment remains the same.”

And with rents being as high as they are, the ability to stabilize your monthly payments and protect yourself from future rent hikes may be even more important. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains what happened to rents in the latest inflation report:

“Inflation refuses to budge. In September, consumer prices rose by 8.2%. Rents rose by 7.2%, the highest pace in 40 years.”

When you rent, your monthly payment is determined by your lease, which typically renews on an annual basis. With inflation high, your landlord may be more likely to increase your payments to offset the impact of inflation. That may be part of the reason why a survey from realtor.com shows 72% of landlords said they plan to raise the rent on one or more of their properties in the next year.

Becoming a homeowner, if you’re ready and able to do so, can provide lasting stability and a reliable shelter in times of economic uncertainty.

The best hedge against inflation is a fixed housing cost. If you’re ready to learn more and start your journey to homeownership, let’s connect.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Here at CENTURY 21 Beal, we are Family, and those WOW moments matter! Contact us today to receive the support of a CENTURY 21 Beak

Our goal is to make Real Estate Simple. 🏡

📲 979-764-2100

💻 susanh@century21bcs.com

🌐 susanhilton.com

Today’s cooling housing market, the rise in mortgage rates, and mounting economic concerns have some people questioning: should I still buy a home this year? While it’s true this year has unique challenges for homebuyers, it’s important to factor the long-term benefits of homeownership into your decision.

Consider this: if you know people who bought a home 5, 10, or even 30 years ago, you’re probably going to have a hard time finding someone who regrets their decision. Why is that? The reason is tied to how you gain equity and wealth as home values grow with time.

The National Association of Realtors (NAR) explains:

“Home equity gains are built up through price appreciation and by paying off the mortgage through principal payments.”

Here’s a look at how just the home price appreciation piece can really add up over the years.

Even though home price appreciation has moderated this year, home values have still increased significantly in recent years. The map below uses data from the Federal Housing Finance Agency (FHFA) to show just how noteworthy those gains have been over the last five years.

If you look at the percent change in home prices, you can see home prices grew on average by almost 64% nationwide over that period.

That means a home’s value can increase substantially in a short time. And if you expand that time frame even more, the benefit of homeownership and the drastic gains you stand to make become even clearer (see map below):

The second map shows, nationwide, home prices appreciated by an average of over 290% over roughly a thirty-year span.

While home price growth varies by state and local area, the nationwide average tells you the typical homeowner who bought a house thirty years ago saw their home almost triple in value over that time. This is why homeowners who bought their homes years ago are still happy with their decision.

Even if home price appreciation eases as the market cools this year, experts say home prices are still expected to appreciate nationally in 2023. That means, in most markets, your home should grow in value over the next year even if the pace is slower than it was during the peak market frenzy when prices skyrocketed.

The alternative to buying a home is renting, and rental prices have been climbing for decades. So why rent and fight annual lease hikes for no long-term financial benefit? Instead, consider buying a home. It’s an investment in your future that could set you up for long-term gains.

Don’t let the shifting market delay your dreams. Data shows home values typically appreciate over time, and that gives your net worth a nice boost. If you’re ready to start your journey to homeownership, let’s connect today.

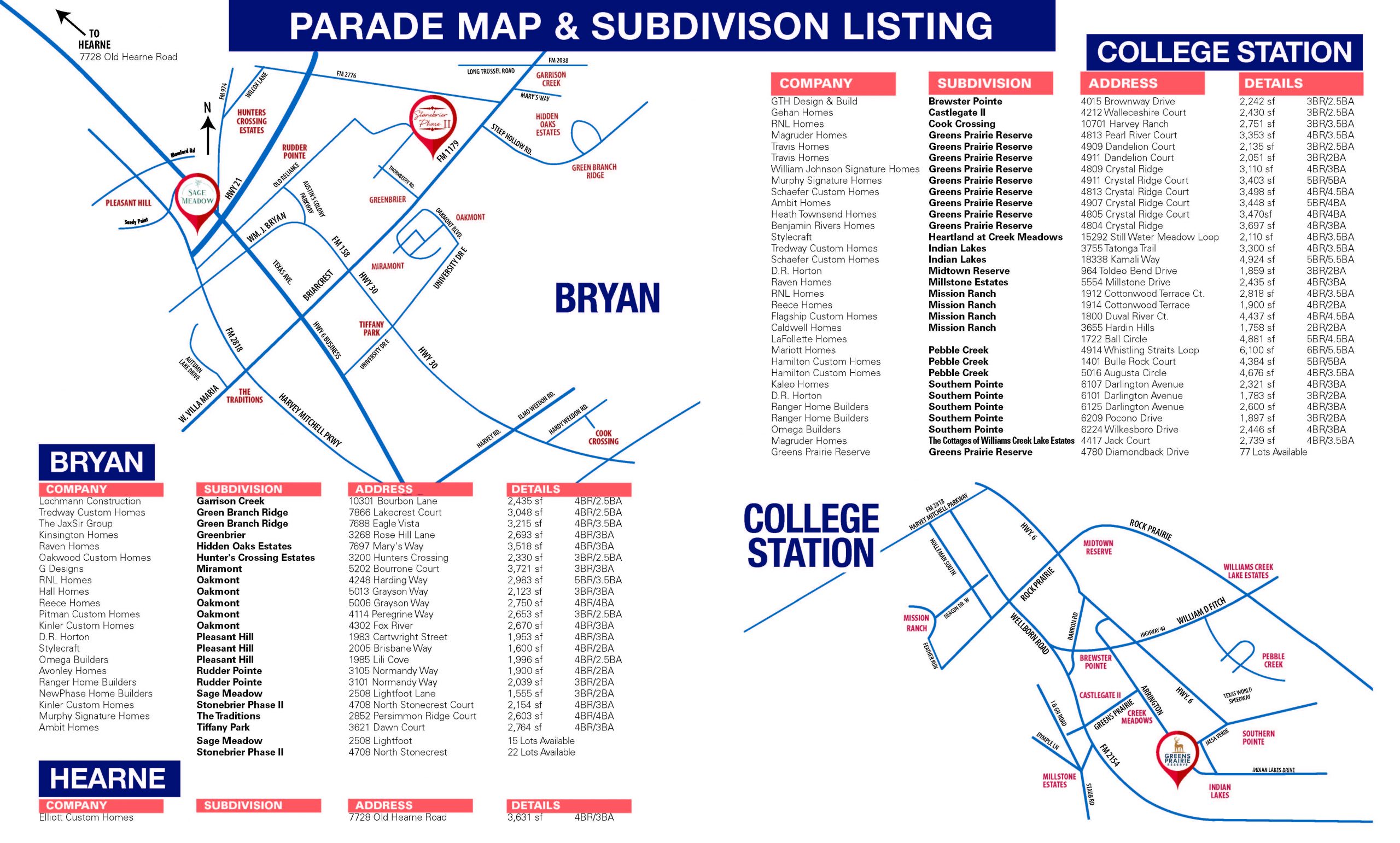

Don’t miss out on Bryan/ College Stations’ biggest Open House event of the year!! Contact us today for more information.

Want to know what the future holds for rates, prices, and inventory? Let’s connect so you have a trusted advisor to answer your housing market questions.

Our goal is to make Real Estate Simple. 🏡

📲 979-764-2100

💻 susanh@century21bcs.com

🌐 susanhilton.com

Changes to the 1-4 Contract are coming. Make sure you are giving your clients the best information by educating yourself. Need more info? Call me today.

Our goal is to make Real Estate Simple. 🏡

📲 979-764-2100

💻 susanh@century21bcs.com

🌐 susanhilton.com